Post Graduate Certificate in Finance (Taxation Laws)

About This Course

Post Graduate Certificate in Finance (Taxation Laws) is designed for people who wish to expand their proficiency & blend it with the wide tax assessment structure.

Post Graduate Certificate in Finance (Taxation Laws) provides the opportunity to learn Indian taxation system and related laws in detail. Taxation is an important part of the work of many tax planners, advisers therefore sound knowledge of laws, and procedures become must. Post Graduate Certificate in Finance (Taxation Laws) caters to the same. The PG Certificate is designed by an Academic Board of distinguished tax practitioners and academicians in the areas of taxation. Holders of the PG Certificate shall be eligible to provide tax plan, advice as tax consultant and file various returns. This PG Certificate includes enactments with recent changes in Income Tax Act and Goods and Services Tax Act, 2017. This program is ideal for individuals seeking career as Tax Consultants, Tax Analyst etc.

Eligibility

- Bachelor's degree holder / Graduate in any discipline from a recognised University.

- International / SAARC Graduate from a recognised / accredited University / Institution.

-

Students who have appeared for final year of examination of their bachelor's degree program and are awaiting results can also apply, subject to successfully completing their bachelor's degree program / graduation within the time period specified by SCDL.

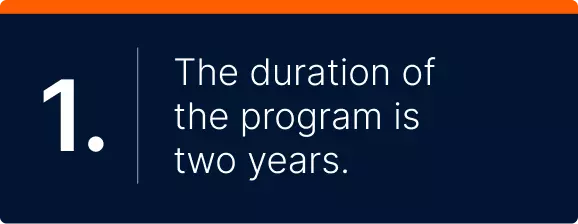

Duration & Validity

Fee Structure

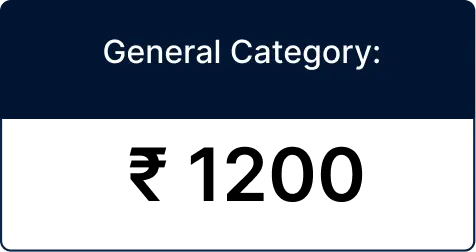

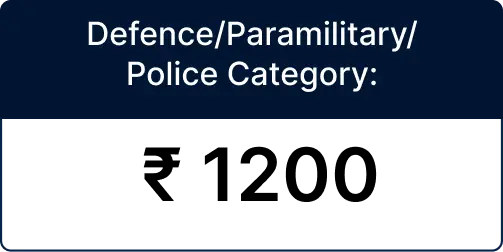

Application Form Fee

The application form fee for applicants is: 500

Note: Application fee is non-refundable

Fee Payment Options

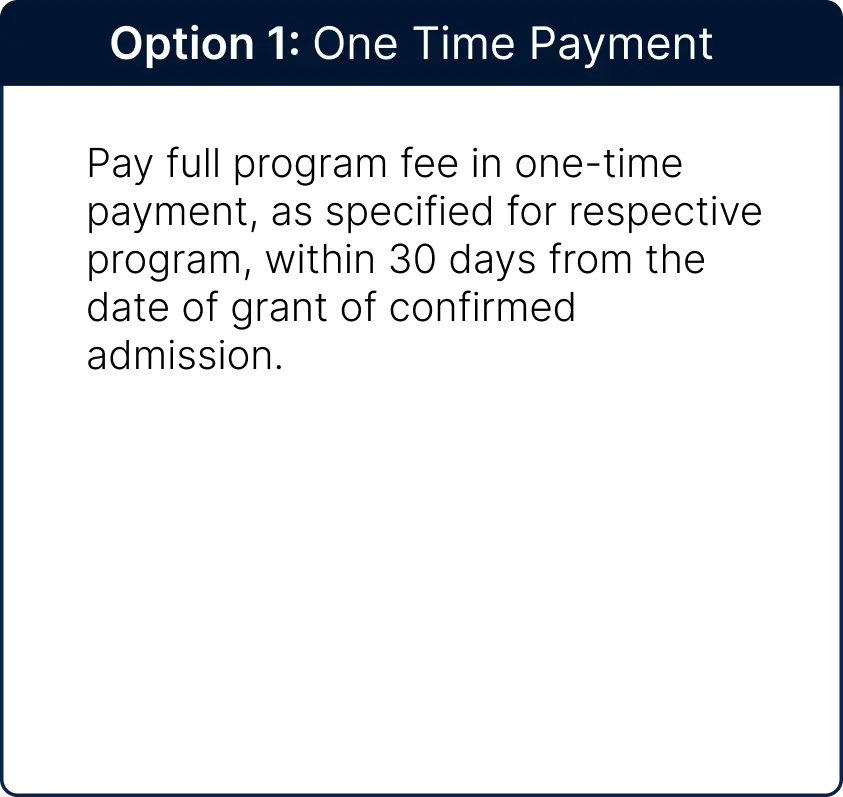

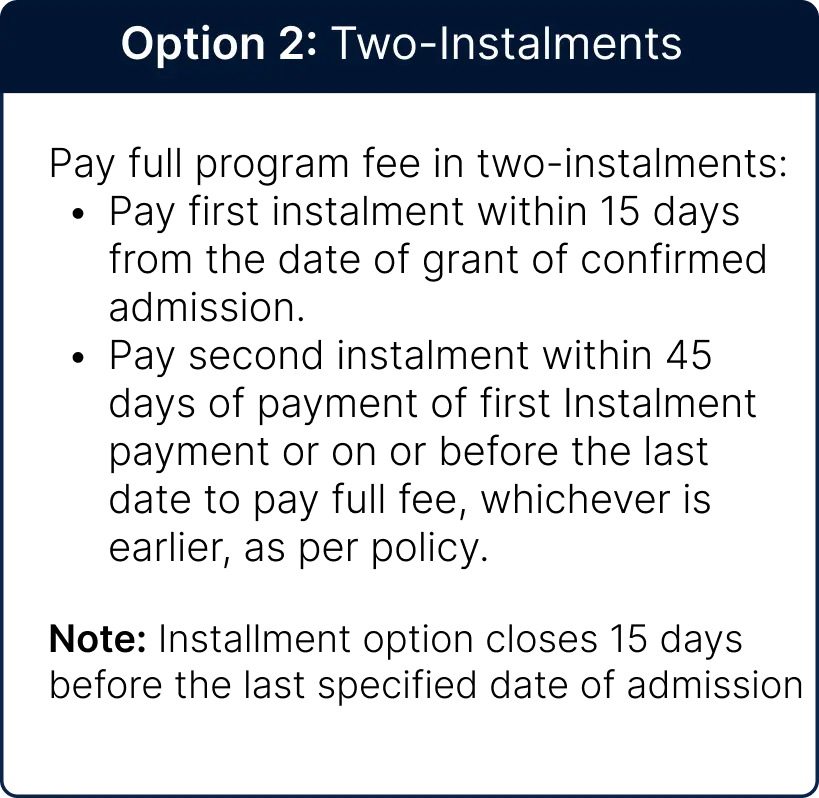

Students have two options to pay the program fees as per below specified timelines.

Fee Payment

| Category | One time full payment | 1st installment | 2nd installment | ||||

|---|---|---|---|---|---|---|---|

| General | ₹ 20,000/- | ₹ 15,000/- | ₹ 10,000/- | ||||

| Defence | ₹ 20,000/- | ₹ 15,000/- | ₹ 10,000/- | ||||

| NRI | $450 | ||||||

| SAARC | $350 | ||||||

Note: Exam fees and project fee is not included in program fee. Pay Exam fees and project fee separately. Pay exam fee per paper per attempt. Exam fees or project fee is non-refundable and non-transferable. SCDL does not accept any type of fee in cash.

Mode of Payments

- Online: Students can pay application form fees, program fees and all exam fees online.

- Demand Draft: Students can pay fees via Demand Draft (DD) drawn in favour of “The Director SCDL, Pune” payable at Pune.